Do i have to report unclaimed property?

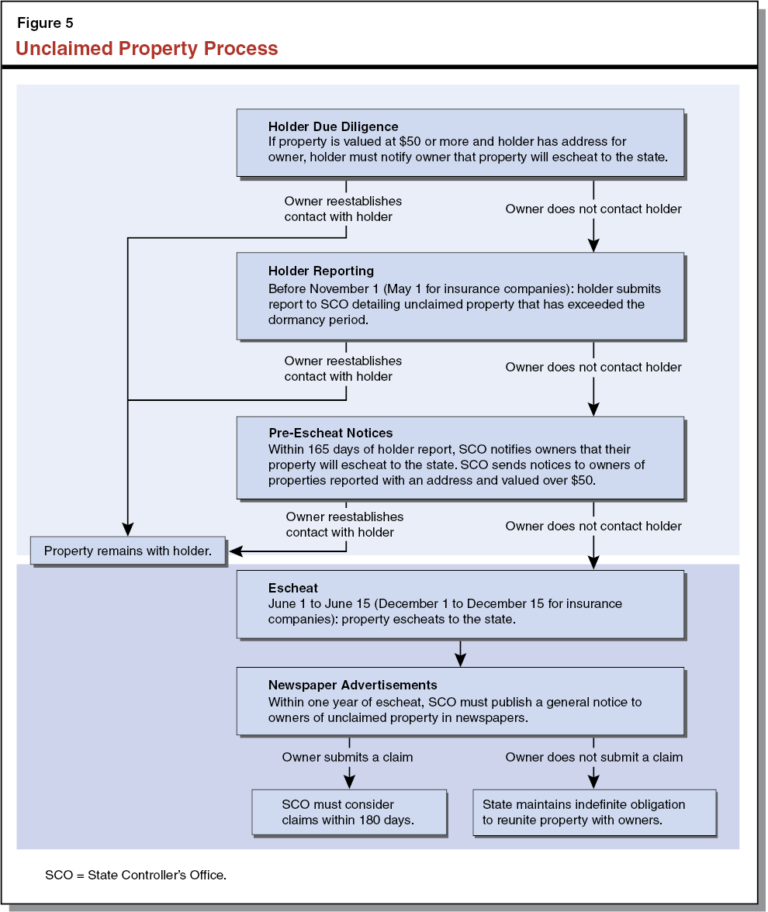

Unclaimed property refers to financial assets or accounts that have been left inactive or unclaimed by their rightful owner for a specific period.

Learn about the laws and regulations surrounding unclaimed property. Understand your legal obligations and how to avoid penalties and fines associated with unclaimed property reporting.

Unclaimed property refers to financial assets or accounts that have been left inactive or unclaimed by their rightful owner for a specific period.

Unclaimed property can be a valuable asset for individuals who discover they have forgotten or unclaimed funds.

Unclaimed property can be a significant issue for both individuals and businesses.

When you claim unclaimed property, understanding the tax implications is crucial. One common question is whether you’ll receive a 1099 form for the unclaimed assets.

Finding unclaimed property can be a pleasant surprise, but what about the tax implications? Understanding whether unclaimed property is taxable is crucial for accurate financial planning and compliance.

Is unclaimed property the same as debt? This is a common question, and the answer is no. Unclaimed property and debt are two distinct concepts.

Have you ever stumbled upon forgotten money or assets that you didn’t even know you had? This isn’t a fantasy; it’s a reality for many people who discover they have unclaimed property.